Farm Asset Division: A 21st-Century Conundrum

The best way to divide farm assets is a challenge that farm families face with each generation of owners. As a parent, we strive to treat and love our children equally, and we want them to know that we love them all the same. When our children perceive their inheritance as a direct indicator of how much we loved them, it makes dividing farm assets a daunting task. The fear of upsetting one’s children often causes parents to divide farm and family assets equally among all heirs. However, it can be beneficial to look at farm and family assets separately when dividing the estate.

Long-term viability for the farm, financial security for the founding generation, and continued family ownership of the farm are documented goals of many farmers1. Research from the Farm Business Institute indicated that family-owned and operated businesses have roughly a 30% success rate in transferring the assets and control from the founding generation to the second generation2. Failure to transfer the business is often caused by a lack or avoidance of planning from the owner generation. This results in the implementation of the state’s succession plan which divides the assets equally among the heirs. Oklahoma State University has created a statistical model that compares various transition strategies and their probabilities of success. The results demonstrate that the most common farm succession strategy of dividing the assets equally among all heirs has the lowest success rate. Farms employing this strategy normally do not continue to the next generation3.

Distributive Justice Principles

When the owner generation makes decisions concerning farm succession, they are subconsciously considering three principles4: (see What is the biggest threat article for further information)

- Equality principle: assets are divided equally among heirs regardless of their contributions

- Proportional equity principle: distribution of assets is in proportion to the heir’s contribution in maintaining or growing the asset

- Needs-based principle: the heirs’ needs are given primary consideration

Research has shown us that the equality principle does not help us reach our goal of transferring the assets and control to the second generation. Therefore, let us delve deeper into the proportional equity principle and needs-based principle3.

Proportional Equity Principle of Distribution

Proportional equity distribution relies on an accurate accounting of the heirs’ contributions. Contributions can be defined as money, labor, management, providing care and maintenance on the home and facilities, mechanical repairs, or being a caregiver that allows the aging parents to stay in their home, etc. There are several questions to consider when dividing farm assets based on proportional equity.

- When do the contributions start? Does it begin when the heir becomes an adult and makes a conscious choice to continue providing labor? Or is childhood labor also considered?

- Are the on-farm heirs compensated at a fair market price for their labor? Or are they receiving below-market wages with a promise of “making things right” with inheritance? Is this arrangement documented?

- Are the on-farm heirs adding value to the farm with their labor and management? Is the owner generation growing the business because they know they have consistent labor and additional management? Would this growth happen without the on-farm heirs, and should they be given credit in some way for this increase in wealth?

- Are the on-farm heirs helping preserve the farm’s wealth by maintaining the asset base? If they weren’t there, would the owner generation keep the business operating at the same level?

- Are the on-farm heirs helping their parents age in place? Are they providing services to the owner generation that would otherwise be an out-of-pocket expense and deplete the asset base?

To help us visualize equality vs proportional equity distribution, let’s look at an example from John Baker, Iowa State University and Dave Goeller from the University of Nebraska. In this example, we will use an example farm that has one person in the owner generation and three heirs. Two of the heirs are off-farm and do not contribute to the farm. The on-farm heir joined the farm in 2000, and we are crediting 50% of the farm’s growth in net worth to the labor and management contributions of this heir.

For this example:

- The farm’s net worth in 2000 is $600,000

- The farm’s net worth in 2020 is $3,600,000

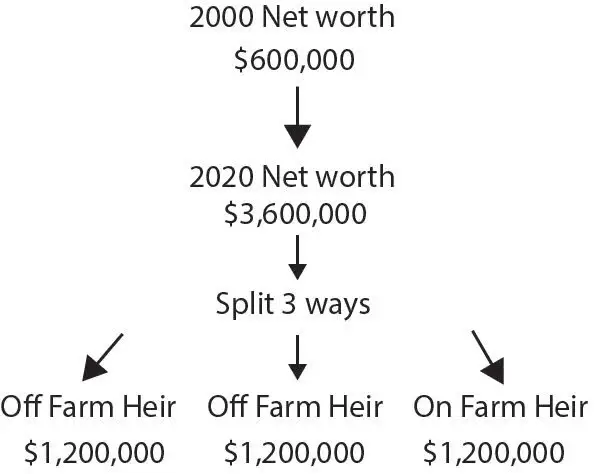

What will the distribution of the farm net worth look like using the equality principle?

Using the equality principle, each heir would receive ⅓ of the farm’s 2020 net worth. $3,600,000 divided three ways leaves $1,200,000 for each heir regardless of their contributions to the farm.

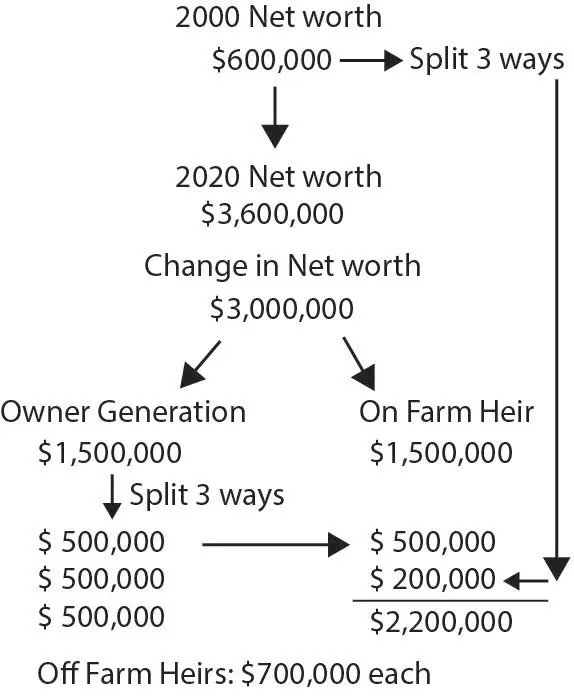

What will the distribution of the farm net worth look like using the proportional equity principle?

Using the proportional equity principle, we would divide the original 2000 net worth equally among the three heirs. The net worth at this time is solely due to the contributions of the owner generation. This gives us a distribution of $200,000 per heir.

We would then consider the change in net worth from 2000-2020 and determine how much of the change was due to the on-farm heir. The change in net worth is $3,000,000 with the on-farm heir being responsible for 50% of that growth, or $1,500,000. The owner generation’s portion of the net worth is divided equally amongst the three heirs. This $500,000 is added to the $200,000 from the 2020 net worth resulting in each off-farm heir receiving $700,000. The on-farm heir received $700,000 plus the $1,500,000 for a total of $2,200,000. While this division is not equal, it is equitable and provides the on-farm heir with compensation for their contributions and increases the likelihood of keeping the farm business viable and in the family.

Each farm will value the contributions of the on farm heir differently. The questions posed above can help you determine what this will look like for your farm. We recognize that this was a simplified example but hope it helps give you a place to start thinking about what proportional equity may look like on your farm. Remember, you may need to treat each asset differently and balance the use of equality, proportional equity, and need-based principles.

Needs-Based Principle of Asset Distribution

The needs-based principle of asset distribution provides heirs with a percentage of the assets based on their need for them. With the needs-based principle the inheritance is not based on an heir’s contribution to the farm but their need for that asset after the parents have passed. A few needs-based examples might be family members with disabilities, medical needs, hardship needs, minor children, etc. Another example of the needs-based principle may be the consideration of keeping the farm in the family. If keeping the farm in the family is a need of the owner generation, they may choose to leave the farm assets solely to the on-farm heir and the family assets to the off-farm heirs.

Communication is Key

In order for any distribution method to be successful, clear and timely communication is key. The owner generation should explain why and how they have chosen to distribute their assets. This conversation can be supported by the use of records and documentation of the on-farm heirs contributions and the value of the business. Documentation of heirs’ contributions should be logical and revisited at least on an annual basis.

While the owner generation may feel they do not need to disclose or discuss their distribution plans, clearly communicating their plans is advisable to maintain family relations and completion of their desired wishes. Many farm owners may choose not to discuss their distribution plans due to the sensitive or difficult nature of these conversations. However, when an unequal division is made, heirs can feel slighted or betrayed by their parents or siblings. This feeling of resentment often leads to ill feelings towards those siblings that have “benefited” greater from the distribution and can taint family memories and relationships.

Families should have thorough conversations about why assets are being distributed in the manner they are to maintain sibling relationships and the desired farm business model for future generations. Clear communication and consistent messaging from the beginning of the planning process will benefit the family in the long run. While the successors may not need to know every detail of the decision-making process, it will benefit the farm, owners, and successors to have an idea of what is planned before it occurs.

Reviewed by:

John Baker, Staff Attorney for the Iowa Concern Hotline, Iowa State University

Bridget Finke, Attorney and Partner of Valley Crossing Law, Baldwin, Wisconsin

References:

- Kirkpatrick, J. 2013. “Retired Farmer – An Elusive Concept.” Choices 28(2):1-5

- Ferrell, S., M. Boehlje, and R. Jones. 2013. “The Policy and Legal Environment for Farm Transitions.” Choices 28(2):1-5.

- Reed, Garret, J. 2017. Assessing The Rate of Success of Alternative Farm Transition Strategies. Oklahoma State University. Master’s Thesis

- Olsen, C. S., and Osborn, T. (2006). “Inheritance: “A Tale of Two Perceptions,” Online Journal of Rural Research & Policy: Vol. 1: Iss. 5. http://dx.doi.org/10.4148/ojrrp.v1i5.33

Additional Resources:

- “Cultivating Your Farm’s Future” workbook and companion guide. This workbook contains invaluable tools to help with your farm’s succession planning.

- “Cultivating Continuity“ the companion guide to Cultivating Your Farm’s Future features additional resources.

Authors

Joy Kirkpatrick is an educator at the University of Wisconsin- Madison Division of Extension. She received both a BS and MS degree from Southern Illinois University-Carbondale. Joy has extensive experience in farm succession planning.

Heather Schlesser is an Associate Professor at University of Wisconsin- Madison Division of Extension. She is an Agricultural educator focusing on dairy reproduction.

Stephanie Plaster is a Farm Management Outreach Specialist and works with the University of Wisconsin- Madison Division of Extension. She is experienced in Farm Succession Planning.

Agriculture Extension Educator for La Crosse County. Kaitlyn's primary role in the county is in Farm Management with an emphasis in Farm Succession Planning.